Content

The difference between a fixed asset and a current asset is that a fixed asset can’t be converted to cash easily or quickly. Fixed assets are tangible items or property that a company purchases and uses for the production of its goods and services. Therefore, to understand the bifurcation of office supplies and the respective categorization, is stationery fixed asset it is important to understand the type of office supplies and their usage. Contingent on the categorization, they are treated in accordance as per accounting treatments. If the purchase amount for office equipment exceeds the threshold amount of $2,500 along with other criteria, you can use the depreciation account.

It’s important to correctly classify your office expenses, supplies, and equipment to make things easier for tax time. Another term for current assets is liquid assets, meaning they are easily converted into income. Fixed assets, also known as property, plant, and equipment (PP&E) and as capital assets, are tangible things that a company expects to use for more than one accounting period.

What Would Appear as Assets on a Manufacturer’s Balance Sheet?

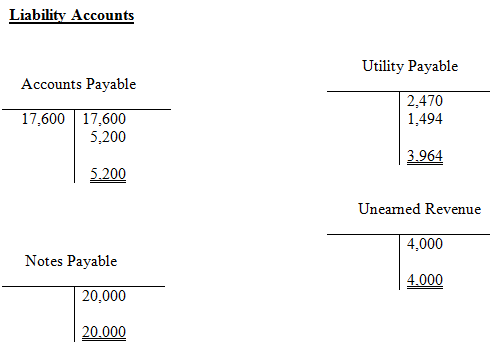

However, they do not contain manufacturing or shipping supplies. Accounting materials and office supplies are crucial in allowing companies to carry out administrative work. These fixed asset accounts are usually aggregated into a single line item when reporting them in the balance sheet. This fixed assets line item is paired with an accumulated depreciation contra account to reveal the net amount of fixed assets on the books of the reporting entity. Examples of fixed costs include buildings, computers, manufacturing equipment, vehicles, office equipment and furniture.

- It is this clause which govern and guide the concerned party on whether to classify a firm’s asset as of revenue or capital expenditure in nature.

- Generally, a company’s assets are the things that it owns or controls and intends to use for the benefit of the business.

- Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

- Explore the various types of fixed assets, identify their characteristics, and see examples.

- In other words, if the item does not have a large impact on your financial statements, you can choose to simply expense it.

They include all the expenses that are required to meet the current operational costs of the business, making them essentially the same as operating expenses . Tracking revenue expenditure allows a business to link earned revenue with the business operations expenses incurred during the same accounting year. On the other hand, current assets are assets that the company plans to use within a year and can be converted to cash easily. While current assets help provide a sense of a company’s short-term liquidity, long-term fixed assets do not, due to their intended longer lifespan and the inability to convert them to cash quickly.

Register Of Fixed Assets for Companies Act

A company, ABC Co., acquires accounting materials and office supplies worth $500. These supplies include paper and stationery used for administrative purposes. Furthermore, the company estimates these supplies to end for 2-3 months.

- Your copy machines, telephones, fax machines and postage meters are included as office equipment fixed assets.

- In simple terms, fixed assets are items that have a life span of one year or longer.

- These include printing and stationery items that companies use to perform tasks in departments.

- If you purchase office supplies in bulk, you can classify them as an asset and expense them as they’re used.

- Hence, the entrepreneur may not categorically tell which assets in his/her business premises belong to fixed or current assets.

However, that process occurs through depreciation over several periods. A fixed asset, or noncurrent asset, typically is an actual, physical item that a company buys and uses to make products or servicea that it then sells to generate revenue. For example, machinery, a building, or a truck that’s involved in a company’s operations would be considered a fixed asset.